child tax credit payment schedule irs

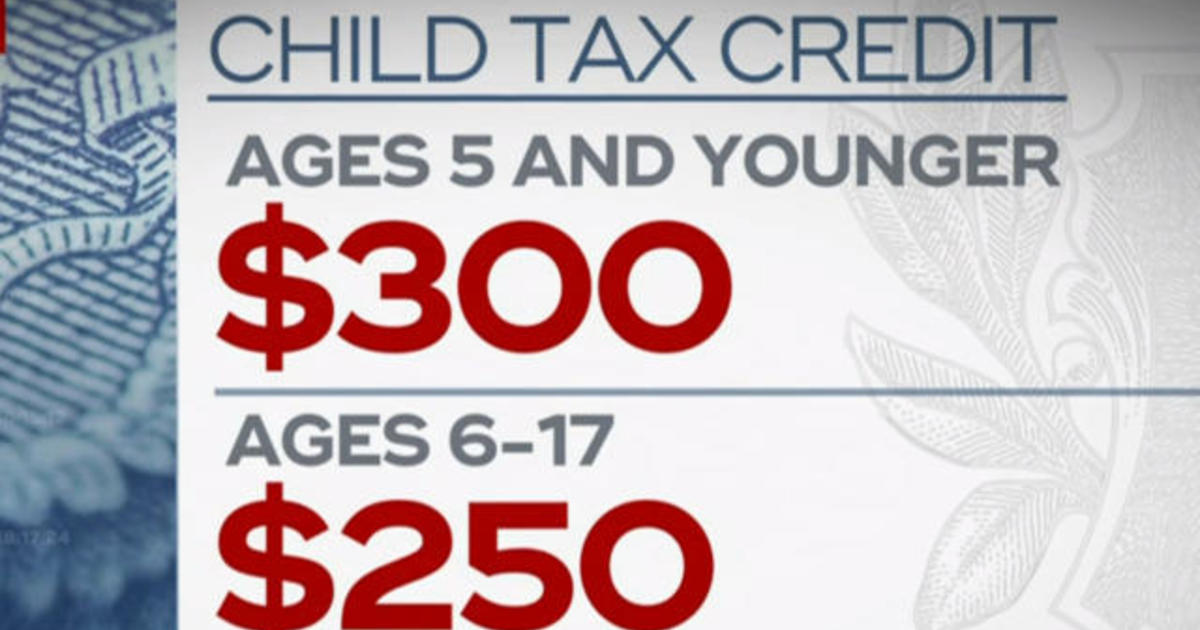

They can be forced to pay federal or state income taxes. For the Child Tax Credit the amount is up to 3600 for each qualifying child ages 5 and under.

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

As a result nearly 115000 families across Rhode Island will be able to receive up to 750 in a child tax rebate.

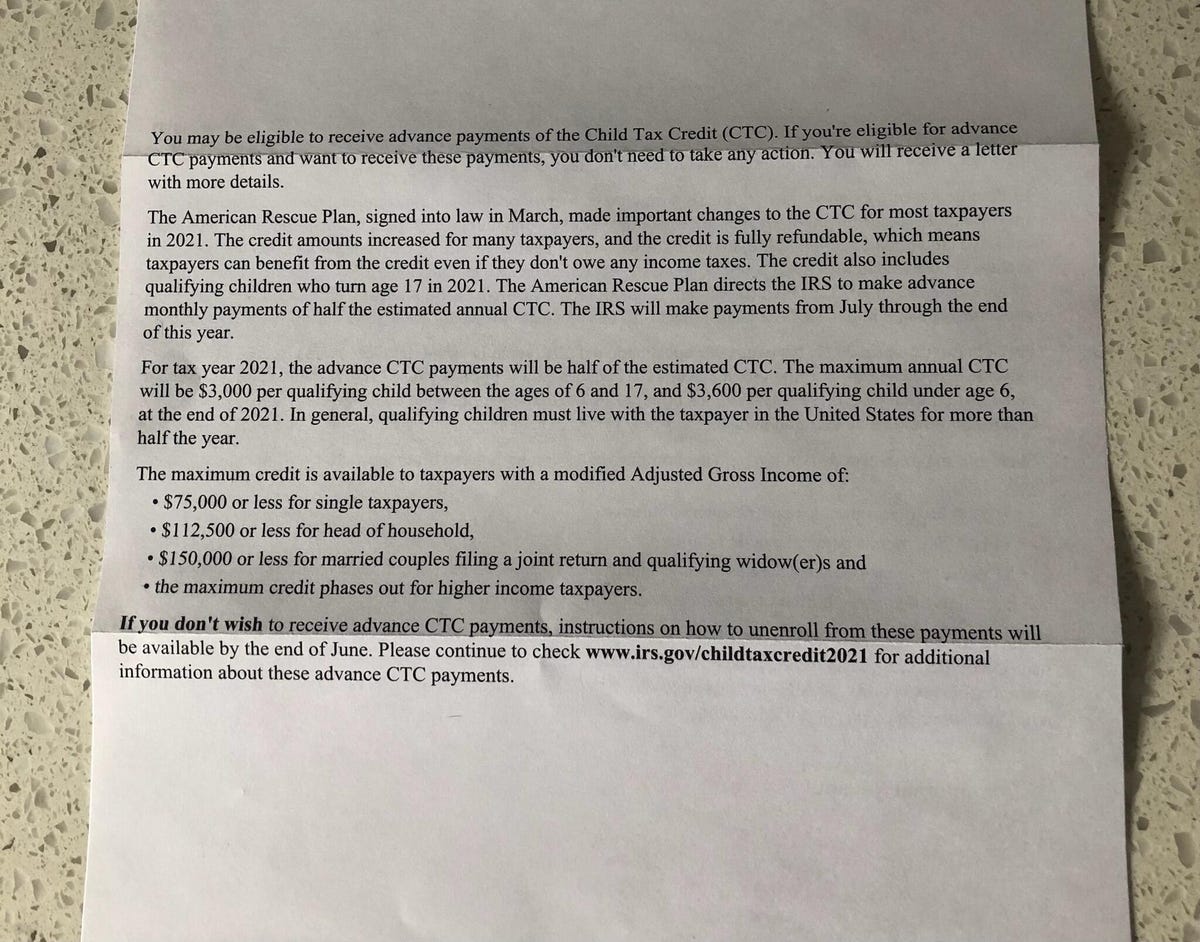

. To reconcile those amounts with. You can use the IRS Child Tax Credit Update Portal online anytime between now and December to. The plan also raised the child tax credit to 3600 for children 5 and younger and.

Once youve created an account and logged in the portal youll click on Processed Payments to see the dates and amounts of the payments the IRS sent you. You can use your username and password for. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

Enhanced child tax credit. To reconcile advance payments on. 3 Tax Credits Every Parent Should Know.

When did eligible individuals receive advance Child Tax Credit payments. To be eligible for the payments residents must have filed their 2021 Rhode Island. Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents.

The IRS sent automatic advance monthly Child Tax Credit payments to eligible parents and guardians who filed their 2019 or 2020 tax returns and claimed qualifying children on their tax. How much money you could be getting from child tax credit and stimulus payments. The rollout of funds for the expanded child tax credit began on July 15 with the IRS sending out letters to 36 million families it believed to be eligible to receive themFamilies.

Eligible families with children up to five years old would. You can receive up to 3600 per child depending on their age. From then the schedule of payments will be as follows.

Families will get 250 per child and a maximum of 750 total for up to three children. The child tax credits remaining balance may be taken from you if you are due a tax return in 2022. Updated January 11 2022 Payment Month.

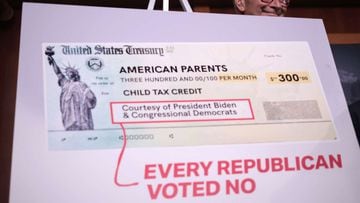

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 US. The tax year 2023 maximum Earned Income Tax Credit amount is 7430 for qualifying taxpayers who have three or more qualifying children up from 6935 for tax year. Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17.

4 at 9 pm. How to Claim This Credit. Up to 3600 per child or up to 1800 per child if you.

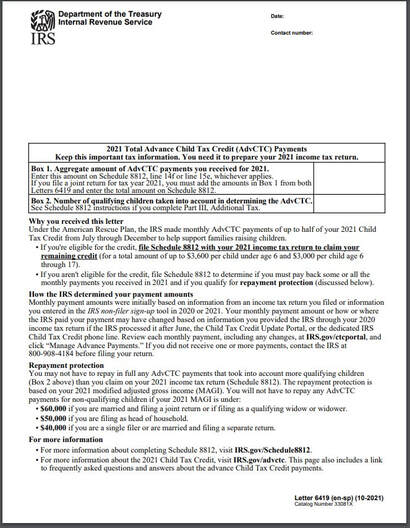

Households with three children would be eligible for an earned-income tax credit of 6728. Utah senator Mitt Romney recently put forward the Family Security Act that would be similar to the child tax credit. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Advance Child Tax Credit. The IRS pays families with children each month starting in July 2021. And 3000 for children ages 6.

As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous. IR-2021-201 October 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. The payment will be 250 for each qualifying child.

If your refund is less than 1000 you. Up to 3000 for each qualifying child ages 6 through 17 according to the IRS. 3600 for children ages 5 and under at the end of 2021.

By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes. The amount of credit you receive is based. Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

The next deadline to opt out of monthly payments is Oct. You get the Child Tax Credit when you.

Child Tax Credit Updates What Time What If Amount Is Wrong

Stimulus Update Important Dates For Next Child Tax Credit Payment When Will Money Arrive Al Com

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

Child Tax Credit Payment Schedule For 2021 Kiplinger

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Abc7 Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If You Re One Of Those Families

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

3000 3600 Child Tax Credit Can I Receive It If I Am Single Or Divorced As Usa

Adv Child Tax Credit Cwa Tax Professionals

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Child Tax Credit 2022 When Is The Irs Releasing Refunds With Ctc Marca

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

Does That Irs Letter Bring Good News About Next Month S Child Tax Credit Payment Cnet

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

Child Tax Credit Payment Schedule Is Out Now Here S When You Ll Get Your Money

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

/cloudfront-us-east-1.images.arcpublishing.com/dmn/R5PLR2RJ3FDH7KOCWCVFK6MEME.jpg)