wv estate tax return

In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a US Estate Tax Return Form 706. 304 558-3333 or 800 982-8297.

Tax Form Templates 5 Free Examples Fill Customize Download

Tax Information and Assistance.

. Start eSigning wv state tax department fiduciary estate tax return forms 2008 by means of tool and join the millions of satisfied clients whove already experienced the advantages of in-mail signing. STC-1232-C Commercial Business Property Return. However public service business property is assessed based upon operations as of December 31 each year.

This final estate tax return is necessary only when an estate is large enough-at least 114 million in assets as of 2019-to require payment of. Up to 25 cash back The executor of the estate is responsible for filing a Form 1041 for the estate. A Washington resident dies in 2019 leaving a gross estate of 4000000.

Payment of any tax balance due may be made by completing the voucher. 2022 STC-1232-I Industrial Business Property Return. IT-140 West Virginia Personal Income Tax Return 2021.

B Returns by personal representative. -- The personal representative of every estate subject to the tax imposed by this article who is required by the laws of the United States to file a federal estate tax return shall file with the Tax Commissioner on or before the date the federal estate tax return is required to be filed. 2022 Trend and Percent Good Tables.

A full-year non-resident of West Virginia and have source income mark IT-140 as Nonresident and complete Column C of Schedule A. The schedule for determining whether an estate tax return is due can be found in the back of your appraisement booklet. Worksheet for Molds Jigs Dies Forms Patterns and Templates.

CST-200CU West Virginia Combined Sales and Use Tax Return Effective 07012016 through 06302017. For tax year 2021 the due date for an annual Estate or Trust West Virginia Fiduciary Income Tax return is April 18 2022. 304 558-3333 or 800 982-8297.

Use the IT-140 form if you are. You dont have to include a copy of the will when you file the return. Tax Information and Assistance.

2016 Pollution Abatement Control Equipment Preapproved Items Prior year forms. STC-1232-I Industrial Business Property Return. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs.

Prior years are also listed in the appraisement booklet. Tax Information and Assistance. The estate incurs funeral and attorneys fees of 50000 during the administration of the estate and the decedent had 50000 in personal debt at death.

I The Internal evenue Service requires the filing of a r Federal Estate Tax return Form 706 for the estate of every citizen of the united States whose gross estate at the time of death was larger than the amount of the federal exemption equivalent. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map. Due date to file 2021 tax return request an extension and pay tax owed.

State of West Virginia. A full-year resident of West Virginia. HOW AND WHERE TO FILE.

The Washington tax due is calculated as follows. Address to which he would return if released from the care facility. Payment of Additional Estate Taxes in WV.

NRW-2 REV 7-20 Statement of West Virginia Income Tax Withheld for Nonresident Individual or Organization 2020 Prior Year Forms. Fillable-Forms Forms and Instructions Booklet Prior Year Forms. CST-200CU West Virginia Combined Sales and Use Tax Return Effective 07012017 through 12312017 Instructions.

304 523-2100 Huntington WV 304 521-6120 Clarksburg WV. Application for Ad Valorem Property Tax Treatment as Certified Capital Addition Property. Ad Valorem Property Tax.

For 2000-2001 the exemption equivalent was 675000. OPT-1 Taxpayer e-File Opt Out Form. The sigNow extension was developed to help busy people like you to decrease the burden of putting your signature on legal forms.

All real and tangible personal property with limited exceptions is subject to property tax. Application for Extension of Time to File a Washington State Estate and Transfer Tax Return. Due date to file 2021 tax returns with approved extension.

As of July 1 each year the ownership use and value of property are determined for the next calendar tax year. An executor or a preparer may request an extension for filing the estate tax return by completing the form above. STC 1239 Sales Listing Form.

Click Here to Start Over. NRW-4 Nonresident Income Tax Agreement. STC-1232-C Commercial Business Property Return.

A Confidential Tax Information Authorization CTIA form is included. The exemption equivalents are. RC Certification of Exemption from Withholding upon Disposition of West Virginia.

Fill-In or Print. 2017 Supplemental Filing Instructions. Your session has expired.

2006 through 2008 2000000. On it youll report estate income gains and losses and will claim deductions for the estate. If applicable include an estimated tax payment.

For further information concerning federal estate tax requirements contact the Internal Revenue Service at 1-800-829-1 040. In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a US Estate Tax Return Form 706. Note that the July monthly period is due on August 20 2016.

West Virginia begins 2022 tax season. West Virginia State Tax Department will begin accepting individual 2021 tax returns on this date. The Department of Revenue administers and enforces West Virginia revenue laws including the regulation of insurance banking and gaming industries as well as.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. Report Tax Fraud Join the Tax Commissioners Office Mailing List Tax Information and Assistance. NRW-3 Information Report of 761 Non partnership Ventures.

The taxable year of the estate or trust for West Virginia income tax purposes is the same as the one used for federal tax purposes. 2022 STC-1232-I Supplemental Filing Instructions for the Industrial Property Return. 1 A return.

SEV-401C Annual Coal Severance Tax Return Effective for Tax Year. The return is filed under the name and taxpayer identification number TIN of the estate. You will be automatically redirected to the home page or you may click below to return immediately.

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

How To File Taxes For Free In 2022 Money

How To Easily Amend Tax Return Before Irs Catches Your Mistakes Internal Revenue Code Simplified

Estate Taxes In Wv Filing A Final Estate Tax Return And Other Responsibilities Blog Jenkins Fenstermaker Pllc

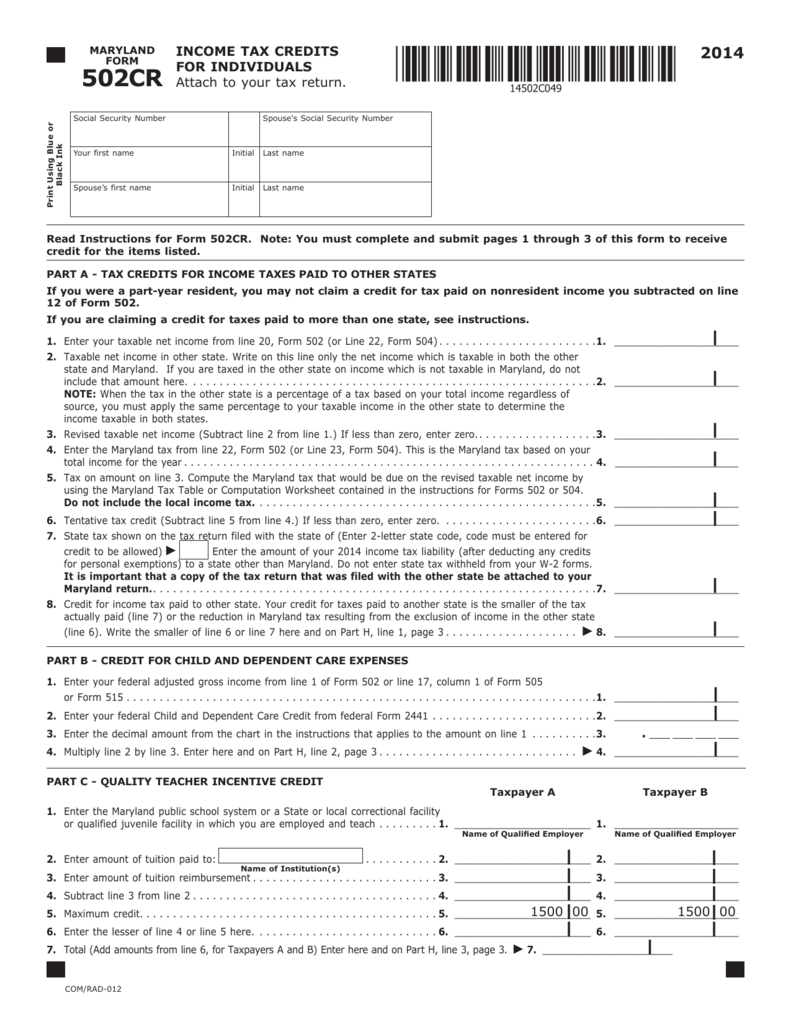

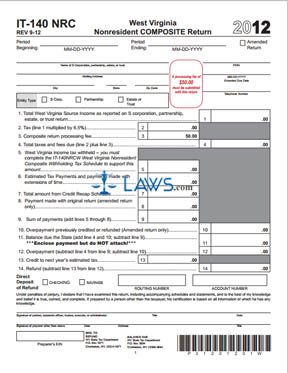

Free Form It 140 Nrc Non Resident Composite Income Tax Return Free Legal Forms Laws Com

West Virginia Tax Forms And Instructions For 2021 Form It 140

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Maine Tax Forms And Instructions For 2021 Form 1040me

New York Tax Forms 2021 Printable State Ny Form It 201 And Ny Form It 201 Instructions

Oklahoma Tax Forms 2021 Printable State Ok 511 Form And Ok 511 Instructions

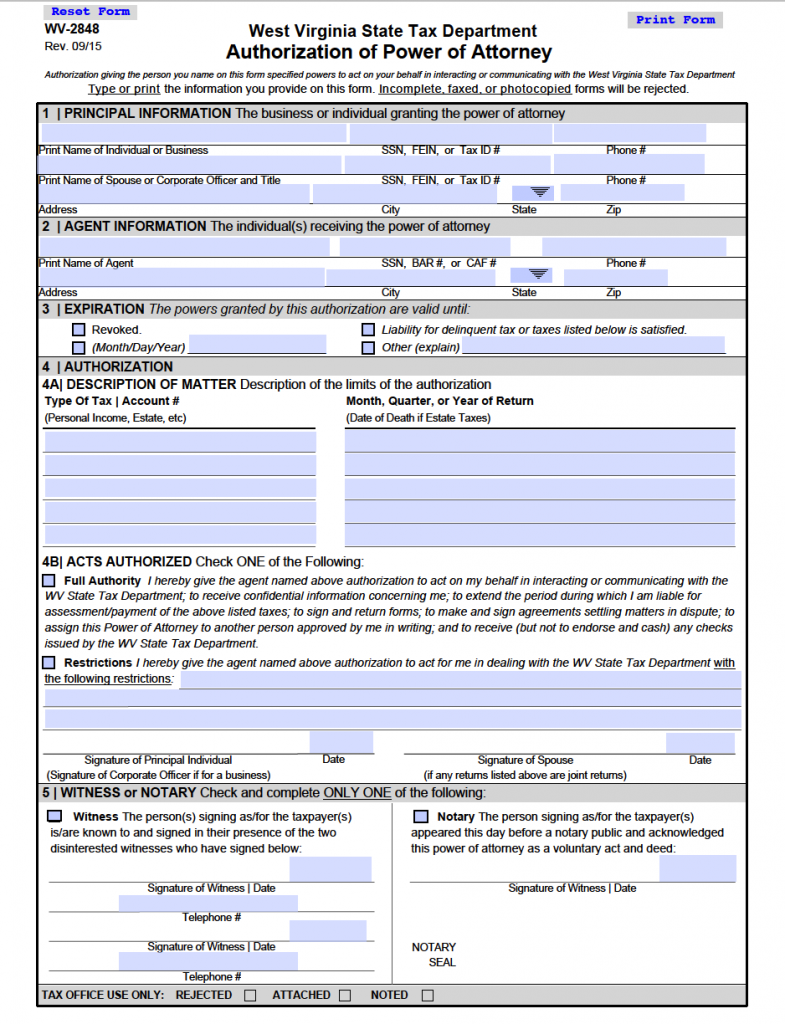

Free Tax Power Of Attorney West Virginia Form Adobe Pdf

Tax Form Templates 5 Free Examples Fill Customize Download

Understanding The 1065 Form Scalefactor

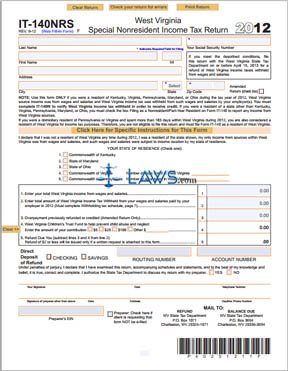

Free Form It 140 Nrs Special Non Resident Income Tax Return Free Legal Forms Laws Com

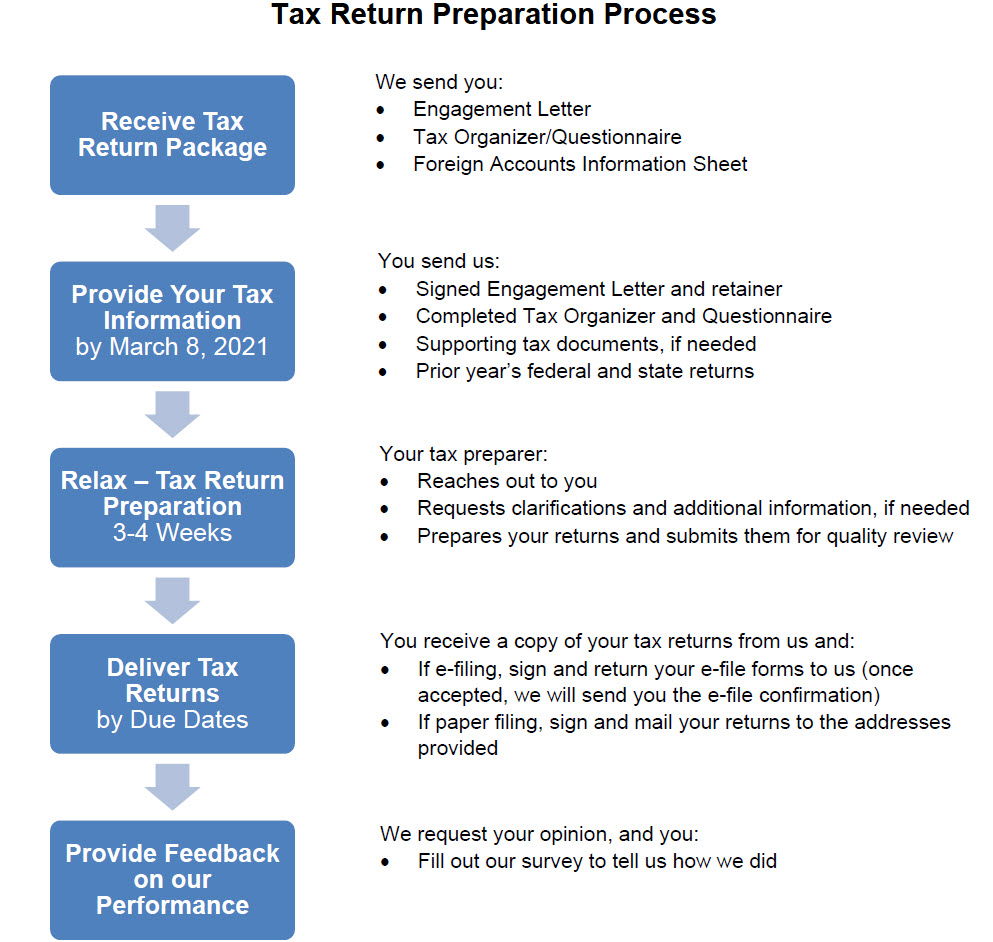

Tax Return Information The Wolf Group

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets